The goal of the Taliesin Institute is to foster a community of learners and, in the process, to raise awareness not only about architecture but about ourselves and our society.

About

The Taliesin Institute partners with university groups, scholars, graduate students, design professionals, and lifelong learners to create opportunities to engage deeply with our collections, programs, and spaces at Taliesin West (AZ) and Taliesin (WI), as well as through online programming. The Institute advances new understandings of Frank Lloyd Wright’s architectural principles and their relationship to social politics, education, materials, technology, and nature and how these ideas can help address contemporary concerns, such as sustainability, uneven growth, affordable housing, and more. The Taliesin Institute also supports exhibitions, publications, research, and academic residencies at our two UNESCO World Heritage sites and in collaboration with external partners.

College and University Programs

College and University programs allow students and scholars to immerse themselves via lectures, panel discussions, presentations, customized programs, and onsite research into the architecture of Taliesin (WI) and Taliesin West (AZ) and its surrounding landscapes.

Program Offerings

o History of Architecture Courses

o Customized Programs and Tours

o Residencies for students and scholars

o Design Competitions

o Guest Lectures

o Onsite Research

o Seminars

o Study Trips

o Design Studio Programs

o Workshops

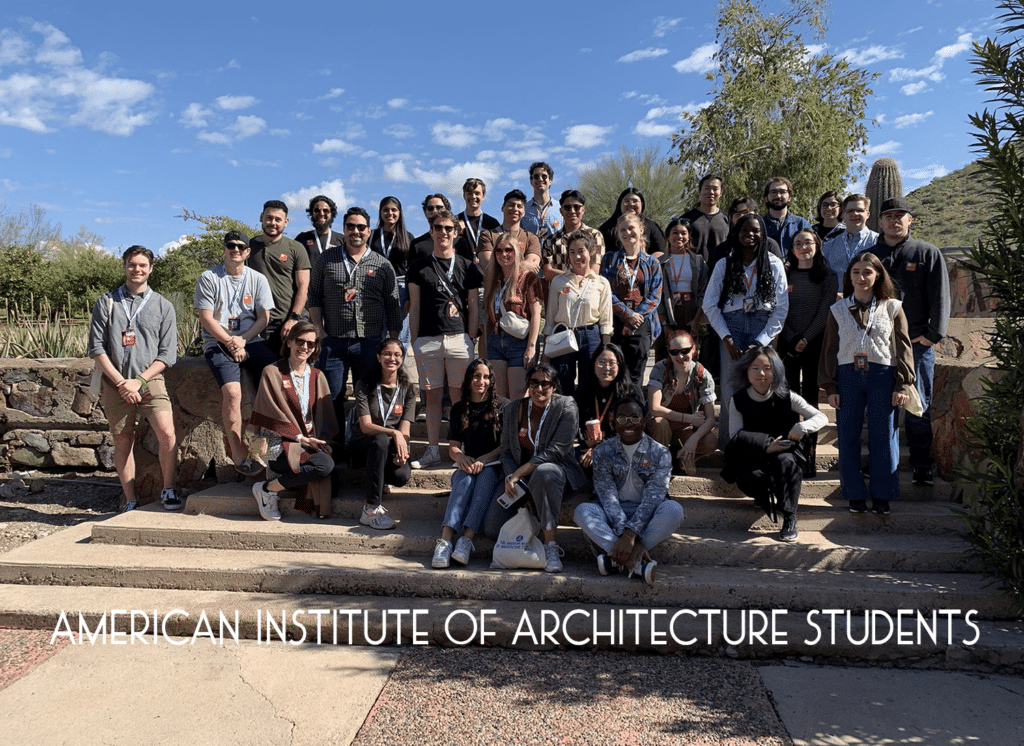

STUDENTS AT TALIESIN WEST

Please note: Space is limited in the program. We advise you to plan at least one semester in advance so that we can best accommodate your desire to participate. Please reach out with any questions you have about timing and availability.

A VISIT TO WINGSPREAD

Participating Universities

o Arizona State University

o Massachusetts Institute of Technology

o Montana State University

o School of Visual Arts

o University of Arizona

o University of Chicago

o University of Geneva

o University of Oklahoma

o University of Ottawa (Canada)

o University of Pennsylvania

o University of Texas at San Antonio

o University of Washington

o University of Wisconsin – Madison

o Washington State University

o Yale University

And more…

Design Professionals

The Taliesin Institute supports professional conferences, symposia, and continuing education for design professionals. Please contact us if your organization is interested in hosting your program at Taliesin or Taliesin West. Recent events include the AIA Taliesin Colloquium 2023: The Evolution of Preservation Standards and Guidelines and DIALOGUES 2023 | Learning By Design Magazine Conference.

Program Offerings

o Conferences

o Convenings

o Symposia

o Continuing Education

FRANK LLOYD WRIGHT & APPRENTICES AT TALIESIN WEST

FRANK LLOYD WRIGHT WITH APPRENTICES OF THE TALIESIN FELLOWSHIP IN 1955 AT THE HILLSIDE STUDIO AT TALIESIN.SEATED LEFT TO RIGHT: JOHN HOWE, FRANK LLOYD WRIGHT, ERIC LLOYD WRIGHT, WESLEY PETERS. STANDING LEFT TO RIGHT: MARK HYMAN, EUGENE MASSELINK, RAJA AEDERI, LING PO, JAMES PFEFFERKORN, ALAN WOOL, DAVID DODGE, THOMAS CASEY, STEPHEN OYAKAWA, DONALD BROWN, KENNETH LOCKHART, JOHN ARMARANTIDES..

Lifelong Learners

The Taliesin Institute offers in-person and online courses, lectures, and workshops on the evolving nature of Wright’s principles of organic design and its relevance to the way we live now and in the future. Upcoming this fall, the Taliesin Institute is partnering with Roundtable at the 92nd Street Y in New York and the Frank Lloyd Wright Building Conservancy on programs. See the Upcoming Events section for more information and to register.

Program Offerings

o Academic Programs

o Continuing Education

o Exhibitions

o Workshops

COURSES

Program | Description | Date | Time | Type |

|---|---|---|---|---|

Frank Lloyd Wright and the Emergence of Modern Architecture | Experts from the Frank Lloyd Wright Foundation, Stuart Graff and Jennifer Gray, explore the modern architecture of Frank Lloyd Wright in an international context and how it attempted to grapple with pressing social and economic problems, from affordable housing and education to environmentalism and urban planning. | Dates: 3 sessions (September 12, 19, and 26) |

| Live Virtual Program |

Everywhere or Nowhere: Frank Lloyd Wright's Broadacre City | Architectural historian and curator Jennifer Gray explores a radical project that Frank Lloyd Wright debuted in the 1930s called Broadacre City, in which he proposed sweeping changes to modern cities and how we live in them. | Date: 1 session (October 4) |

| Live Virtual Program |

Wright's Imperial Hotel at 100: Frank Lloyd Wright and the World | This course commemorates the centenary of Frank Lloyd Wright’s Imperial Hotel, one of the architect’s most ambitious commissions completed in 1923 in Tokyo, Japan. Curators Ken Tadashi Oshima and Jennifer Gray discuss the evolution of the Imperial Hotel’s design and use the project to explore themes and ideas that preoccupied Wright throughout his career—including his fascination with Japanese prints, the relationship between architecture and landscape, a deep interest in global cultures, and more—the subject of their upcoming exhibition Wright’s Imperial Hotel at 100: Frank Lloyd Wright and the World on view at three venues in Japan from October 21, 2023 – May 12, 2024. | Date: 1 session (January 23, 2024) |

| Live Virtual Program |

For a full listing of courses offered by the Frank Lloyd Wright Foundation on Roundtable |

||||

EXHIBITION

Wright’s Imperial Hotel at 100: Frank Lloyd Wright and the World

Opens October 21, 2023 at the Toyota Museum of Municipal Art, Toyota City, Japan

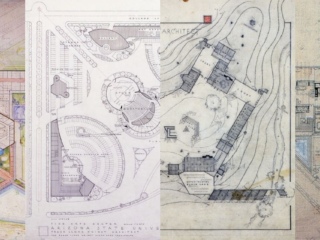

This exhibition celebrates the 100th anniversary of Frank Lloyd Wright’s Imperial Hotel in Tokyo, Japan, one of the architect’s most ambitious and elaborate commissions, and takes the 1923 design as a point of departure for exploring other themes and projects created by the American architect around the world. These include Wright’s fascination with Japanese prints, the relationship between architecture and landscape, concrete blocks and building systems, and an enduring interest in global cultures that manifested in projects as distinct as Wright’s prairie houses, such as the Darwin Martin and Avery Coonley Houses, La Miniatura, San Marcos-in-the-Desert, and Fallingwater, as well as the Guggenheim Museum, an urban plan for Baghdad, and a Mile-High skyscraper design. Original architectural drawings together with photographs, models, films, prints, furniture, and more will be on view in this first exhibition on Frank Lloyd Wright in Japan in over twenty-six years.

Dates/Venues

October 21 – December 24, 2023

Toyota Municipal

Museum of Art

(Toyota City, Aichi)

Organizers: Toyota Municipal Museum of Art, Frank Lloyd Wright Foundation

Co-organizer: The Chunichi Shimbun

January 11 – March 10,

2024

Panasonic Shiodome Museum of Art

(Minato-ku, Tokyo)

Organizers: Panasonic Shiodome Museum of Art, Frank Lloyd Wright Foundation, The Tokyo Shimbun

Aomori Museum of Art (Aomori City, Aomori)

Organizers: Frank Lloyd Wright Exhibition Aomori Executive Committee (Aomori Museum of Art, Radio Aomori Broadcasting, Aomori Prefectural Tourism Federation), Frank Lloyd Wright Foundation

LECTURES

lectures

Imperial Hotel courtesy of the Eric M. O’Malley Collection/OA+D Archives

Unpacking the Imperial Hotel at 100: Frank Lloyd Wright and the World

A four-part online lecture series

on the nature of materials, people, and place

The Imperial Hotel commission was an opportunity for Wright to experiment with themes and ideas that had been in gestation for years and that would later resurface in his work: Japanese prints, the relationship between architecture and landscape, and a deep interest in global cultures. Talks, moderated by Jennifer Gray, Vice President of the Taliesin Institute at the Frank Lloyd Wright Foundation, will highlight the network of people and places that intersect with Wright’s experience in Japan and resurface in projects around the world.

Co-sponsored with the Frank Lloyd Wright Building Conservancy

Professor Ken Tadashi Oshima, University of Washington

Thursday, November 9, 2023

7 p.m. EST / 4 p.m. PST

Matthew Skjonsberg, Director, Praxis Institute

Thursday, December 7, 2023

7 p.m. EST / 4 p.m. PST

Atsuko Tanaka, Ph.D. architectural historian; lecturer, Kanagawa University

Thursday, January 11, 2024

7 p.m. EST / 4 p.m. PST

Kathryn Smith, author, historic preservation consultant, and lecturer

Thursday, February 8, 2024

7 p.m. EST / 4 p.m. PST

Registration is required. Tickets are available for the full series ($45) or for each session individually ($15). Members of the two presenting organizations may register for the full series at the discounted rate of $30. In order to receive the member rate for the full series:

-

Frank Lloyd Wright Building Conservancy members must log in to their member account after clicking the button below.

-

Frank Lloyd Wright Foundation members must use the coupon code they receive via email.

If you have questions about these events or require registration assistance, please email Events@SaveWright.org.

Resources

The Taliesin Institute offers scholars, students, educational institutions, and professional organizations access to scholarly resources for educational and professional research. To engage with our collections please send an email to Institute@FrankLloydWright.org or call 480.627.5354 to schedule an appointment.

Resources Offerings

o Collections (Archival and Special Collections)

o Guest Speaker (based on availability)

o Library

o Publications

APPRENTICES AT TALIESIN WEST

Gallery

Jennifer Gray, Ph.D.

Meet Our Director

Jennifer Gray is an architectural historian and curator, with a special emphasis on the work of Frank Lloyd Wright. She studies modern architecture and how designers and activists used architecture, cities, and landscapes to advance social change in the twentieth century. She has curated several exhibitions on Wright, including a major retrospective at The Museum of Modern Art (MoMA), and published numerous articles and catalogs on Wright. She has taught in the Graduate School of Architecture, Planning and Preservation (GSAPP) at Columbia University; the College of Architecture, Art, and Planning at Cornell University, and at MoMA. Gray received her Ph.D. from Columbia University.

For more information regarding the Taliesin Institute or its programs, please send an inquiry to Institute@FrankLloydWright.org